Flagstaff Car Insurance - Arizona

Enter your zip code below to view companies that have cheap auto insurance rates.

Anybody who owns a ride ought to have car insurance. This is especially true for someone who is residing in Flagstaff in Arizona. That's because the city has an entire population of 71,975, according to the latest census. To provide you a much better idea, every square kilometer has about 420 people.

Speaking of that, the natives of Flagstaff are comprised of the following: 77.3% are White, 2.5percent are Afro-Americans, 2.7percent are Asians, 8.6% are Alaskans and Native Americans, 4.6percent are multi-racials, and the remaining are 4.1percent of the populace.

Here are different statistics between the town's locals: 49.4percent are males, 50.6percent are gals, 32% are married, and 25.1 years old is the mean age.

As it is a populous city, there are lots of cars in Flagstaff, meaning your risk of being at a car mishap is relatively significant. That is the reason you need to have auto insurance. Having one means that you can be liberated from the fiscal burden of paying for losses and damages in case you get involved in a car disaster in which the guilty party is you.

Do not be like other persons in the city who don't want to buy auto insurance. Many believe that it is not necessary because they drive very cautiously. Even if that is true, there are drivers out there who are much less vigilant as they are when driving.

If a motorist crashes into your vehicle and he or she doesn't have any car insurance, you are at the losing end. It might take a while prior to the other party covers the fix. Consider yourself unlucky in the event the person isn't employed. That could happen because in the Flagstaff the unemployment rate is 7.7%. Only 45.2% of the local inhabitants have college degrees, and just 67.5percent of them have jobs. All of these numbers are derived from a 2017 survey.

What if it is your ride that crashes into someone else's ride? If that is the case, then you're the person who's considered as the liable party. It goes without saying that you'll need to pay for the required costs, from repairing the damaged car to taking care of the medical and other needs of another party.

It is not always the car that yours crashed into has a one passenger only. What if the all family was in the vehicle? In Flagstaff, the average size of neighborhood families is 3.04.

What if many of these family members have jobs and, due to the accident, they are no longer able to do the job? Being the liable party, you'll be the person to shoulder the losses, such as their yearly wages. That will surely leave a big dent in your bank account particularly because the average income of today's household in Flagstaff is $51758, and approximately 22percent are earning wage from the six-figure range!

Aside from automobiles and people, a automobile accident in which you're the person who's is at fault may at times involve a property, including a abode. Based on a 2017 statistic, an owned property in Flagstaff averages at $294858. On the other hand, a rented property averages at $1250. The point is that acquiring a house damaged in the town isn't affordable!

As you can see, it is easier on the budget for you to purchase automobile insurance than shouldering the damages and losses with money from your pocket. Just remember that the more severe the automobile accident is and the more individuals are injured, the higher the total cost of the road disaster.

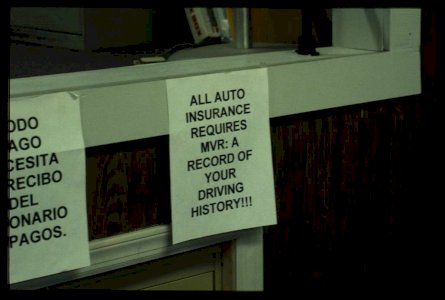

If your reason for not getting automobile insurance is the exorbitant monthly or annual prices, then you will be happy to know that there are many ways to bring down auto insurance prices. For instance, having a leading driving record can convince a automobile insurance company to reduce your premiums. The exact same may take place if you install anti-brake lock, side airbags, along with other security features into your ride.

The measures that you might try to enjoy lower automobile insurance monthly or annual premiums do not start and end there. These days, there are various devices that you may get your hands on to prove to the auto insurance provider that you're not likely to be a cause of headache. One of these is a GPS tracker as the -111.6195 (longitude) and 35.1872 (latitude) will function as proof that you don't park your ride in questionable areas. Another one is a dashcam that will record your every move and can demonstrate that you are not the at fault party only in the event you encounter a car accident.

So when is the suitable time to buy car insurance? Right now during America/Phoenix business hours! A car accident can occur at any given time and in any given place. This is true even if you're the most careful and experienced driver in Flagstaff and around the entire planet. Don't be caught with no car insurance when you become involved witha car accident!

Flagstaff Cheapest Companies

| Cheapest Companies | Quotes |

|---|---|

State Farm | $43/mo |

Travelers | $100/mo |

Liberty Mutual | $145/mo |

The General | $153/mo |

American Family | $174/mo |

Around Cities

Arizona Cities | |

|---|---|

| Phoenix | $199/mo |

| Tucson | $149/mo |

| Mesa | $163/mo |

| Chandler | $142/mo |

| Flagstaff | $124/mo |

| Arizona | $155/mo |

Flagstaff Best Companies

| Best Companies | Score ? | Quotes ? |

|---|---|---|

Clearcover | 97 | $95/mo |

American Family | 89 | $171/mo |

Liberty Mutual | 82 | $134/mo |

Mercury | 81 | $207/mo |

Flagstaff Drivers by Age

| Driver Age | Avg. Monthly Cost |

|---|---|

| teens | $283 |

| 20s | $187 |

| 30s | $129 |

| 40s | $109 |

| 50s | $151 |

| 60s | $140 |

| 70s | $294 |

| 80s | $245 |

Driving History

| Driving History | Avg. Monthly Cost |

|---|---|

| No Violation | $157 |

| Speeding Ticket | $169 |

| At-Fault Accident | $216 |

| Failure to Stop for Red Light / Stop Sign | $129 |

Flagstaff Scores

| Credit Tie | Avg. Monthly Cost |

|---|---|

| Excellent | $165 |

| Good | $196 |

| Average | $149 |

| Poor | $171 |

Flagstaff Ratings

| Cities with Most DUIs Rank | #2 |

| Cities with Most Moving Violations Rank | #1 |

| Most Popular Car in state | Ford F-Series Pickup |

| Cities with Most Speeding Tickets Rank | #2 |

| Cities with Most Suspended Licenses Rank | #35 |

Flagstaff Zipcodes

- 86001

- 86002

- 86003

- 86004

- 86011

Other cities of same state

Other cities from different states

Potential Rate Discounts

If you qualify for discounts, you may save the amounts shown below.

| Discount | Savings |

|---|---|

| Multi-policy | $64 |

| Multi-vehicle | $61 |

| Homeowner | $17 |

| 5-yr Accident Free | $81 |

| 5-yr Claim Free | $86 |

| Paid in Full/EFT | $47 |

| Advance Quote | $66 |

| Online Quote | $94 |

Compare Rates and Save

Find companies with the cheapest rates in your area

Discounts are estimated and may not be available from every company or in every state.