Can I use a different address for car insurance?

Why its Wrong to Use a Different Address for Cheaper Car Insurance

Why its Wrong to Use a Different Address for Cheaper Car Insurance, the Insurance Institute for Highway Safety says. The Insurance Institute for Highway Safety considers a drivers Occupancy Rate to be the number of miles driven per year, says Susan Ewell, the institutes director of research and analysis. Is a low-mileage driver who drives a lot and saves money. Loses out on coverage if they get into a collision with the drivers insurance company. Loses coverage if the driver cant pay their deductible. Loses coverage if a driver has a history of accidents. Loses coverage if the driver has had a DUI or is a convicted drunk driver. Loses coverage if the driver is found to be underinsured. Loses coverage if they are found to be underinsured. Loses coverage if they have a history of injuries. Loses coverage if the driver has a history of traffic violations. Loses coverage if they have had a DUI, a DWI, or multiple traffic violations. Loses coverage if they are found to be uninsured. Loses coverage if they have a history of auto theft.

How to get car insurance without an address

How to get car insurance without an address. You're reading this on mobile. And if youre using this for your work, please consider turning off your phone. As the nations most popular car insurance provider, we've made the decision to let you know how to get the most out of your smartphone. Get the latest from CarInsurance.

Why is your address important for car insurance

Why is your address important for car insurance? If you live in an area with higher auto insurance costs, you might want to consider changing your address or even moving. If you live in the Midwest or Northeast, you might want to consider moving to a location with lower auto insurance costs. If you live in the South, you might want to consider moving to a location with lower auto insurance rates. If you live in the Midwest, you might want to consider moving to a location with higher auto insurance costs. If you live in the Northeast, you might want to consider moving to a location with lower auto insurance costs. If you live in the Midwest, you might want to consider moving to a location with lower auto insurance costs. If you live in the Southwest, you might want to consider moving to a location with higher insurance rates. If you live in the Midwest, you might want to consider moving to a location with lower auto insurance rates. If you live in the Northeast, you might want to consider moving to a location with higher insurance rates. If you live in the Southwest, you might want to consider moving to a location with lower insurance rates.

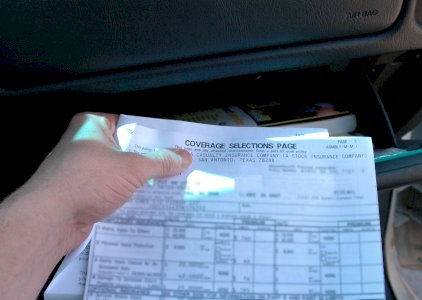

Potential Rate Discounts

If you qualify for discounts, you may save the amounts shown below.

| Discount | Savings |

|---|---|

| Multi-policy | $64 |

| Multi-vehicle | $61 |

| Homeowner | $17 |

| 5-yr Accident Free | $81 |

| 5-yr Claim Free | $86 |

| Paid in Full/EFT | $47 |

| Advance Quote | $66 |

| Online Quote | $94 |

Compare Rates and Save

Find companies with the cheapest rates in your area

Discounts are estimated and may not be available from every company or in every state.