Los Angeles Car Insurance - California

Enter your zip code below to view companies that have cheap auto insurance rates.

When it comes to car insurance premiums, here is a universal guideline : the more persons are using automobiles, the greater the cost of monthly or yearly payments. That's because there are more individuals that could get involved with accidents involving cars .

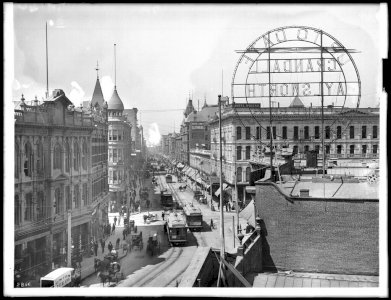

It doesn't come as a big surprise why monthly or annual automobile insurance premiums tend to be steep for anyone who is staying in Los Angeles. The approximated municipal population of Los Angeles in California is 3,999,760, meaning that you will find 3295 persons for every square kilometer.

The main reason why Los Angeles is populous is the fact that it is home to persons of different races and cultures . If you have a look at the town' demographics,then you may realize that it consists of the following: white (52.2percent), Afro-American (8.9%), and Asian (11.7%). There are also Native Americans and Alaskans (0.7percent), multi-racial (3.5%), and others (22.9percent). Incidentally, the mean age of individuals residing in town is 35.2.

If you are living in Los Angeles and you own a vehicle, it's very likely that one of your main concerns in regards to getting car insurance is that you will need to pay steep monthly or annual payments. There is not any need to worry because this doesn't always need to be the situation.

Yes, it's likely to have automobile insurance in Los Angeles without going beyond your budget. The secret to getting your hands on affordable policies is to shop around during company hours in the America/Los_Angeles time zone!

Automobile insurance firms themselves suggest for you to opt for auto insurance that meets the minimum insurance requirement in California. This will require you to shell out a little bit of money on a monthly or yearly basis, but it is better than not owning some automobile insurance plan.

Did you know that, in certain countries, not having a minimum automobile insurance plan is unlawful? And did you know that having automobile insurance is less costly than being in an auto disaster in which you're the person who's guilty?

One of the reasons why it is likely that you find yourself knee-deep in debts in case you do not own auto insurance is that you will need to compensate each and every being in the car that your car collided with, particularly if you're at fault. You don't desire to be involved in a collision between a household car particularly in Los Angeles in which the average family size is 3.63. In the event the full family is in the car the moment your ride crashed into it, then you are going to need to pay for each one's medical care.

Regrettably, your load doesn't start and end with paying for every household member's medical attention. You'll also need to look after the losses when somebody gets injured and is not able to do the job.That's not going to be cheap especially in Los Angeles where the mean household income is 54501, and approximately 27% of the workforce are getting not less than $100,000.

Besides hurting people, a car mishap can also leave you damaged properties. Repairing any property that you damage without you having automobile insurance is not easy on the wallet, particularly if the damage is extensive. As numerous as 36.8% families own their homes.

According to some 2017 statistic, the median value of owned abodes in Los Angeles amounts to $549600. Damaging a rented abode is not inexpensive, either. According to the same statistics, the mean quantity of rent covered by households nowadays in Los Angeles amounts to $2085.

In regards to a car disaster, you are either the man or woman who's at fault or the victim. We talked about how expensive it is to involve yourself in a car crash were you are the at fault party and you don't own any automobile insurance policy.

Now, let's discuss an automobile accident in which the other person is the one who is at fault. Money-wise, the at-fault individual's auto insurance carrier will take care of the costs involved. This usually means that you will not spend a dime. However, there's a problem in the event the individual who caused the accidentdoes not have automobile insurance. A much larger problem can appear if he or she does not possess a good supply of income.

In Los Angeles, roughly 8.1% of the locals don't have any works, states a 2017 data. The very same data adds that 33.1percent of the locals finished college, and 66.3% have occupations.

Clearly, staying in Los Angeles and using a ride, too, incolves purchasing auto insurance. If you're a budget-conscious person, there are lots of measures which you might take to keep your automobile insurance monthly or yearly premiums from leaving a large hole in your pocket. Some of the situations that you may do may also cause you to be eligible for some auto insurance reductions.

One of those steps which you may take to lower your premiums is incorporating some security features to your car. There are many choices for you to choose from, ranging from side airbags to anti-lock brakes. The installation of specific devices demonstrates that you are a careful driver, and this may encourage the car insurance provider to provide you cheaper premiums. A few of the tools that you may add toyour ride with include a dashboard camera plus a satellite navigational device that will inform the automobile insurance insurer where you're on the Earth by indicating your -118.4068 (longitude) and 34.1139 (latitude).

In summary, it is a good idea for you to have automobile insurance if you're living in Los Angeles. It is irrelevant whether you're one of the numerous 49.5percent gentlemen or 50.5percent ladies, or if you're unmarried or one of those 38.6% married people. Because accidents often strike when you least expect them, having car insurance can save you from the surprise of having to shoulder steep car-accident relevant expenses.

Los Angeles Cheapest Companies

| Cheapest Companies | Quotes |

|---|---|

GEICO | $90/mo |

State Farm | $100/mo |

Nationwide | $137/mo |

Mercury | $159/mo |

American Family | $260/mo |

Around Cities

California Cities | |

|---|---|

| San Diego | $101/mo |

| San Jose | $100/mo |

| San Francisco | $134/mo |

| Fresno | $103/mo |

| Los Angeles | $148/mo |

| California | $118/mo |

Los Angeles Best Companies

| Best Companies | Score ? | Quotes ? |

|---|---|---|

Clearcover | 97 | $173/mo |

Mercury | 81 | $227/mo |

Travelers | 80 | $205/mo |

National General | 58 | $358/mo |

Los Angeles Drivers by Age

| Driver Age | Avg. Monthly Cost |

|---|---|

| teens | $568 |

| 20s | $380 |

| 30s | $275 |

| 40s | $289 |

| 50s | $314 |

| 60s | $298 |

| 70s | $275 |

| 80s | $355 |

Driving History

| Driving History | Avg. Monthly Cost |

|---|---|

| No Violation | $302 |

| Speeding Ticket | $388 |

| At-Fault Accident | $340 |

| Failure to Stop for Red Light / Stop Sign | $349 |

Los Angeles Scores

| Credit Tie | Avg. Monthly Cost |

|---|---|

| Excellent | $320 |

| Good | $308 |

| Average | $224 |

| Poor | $267 |

Los Angeles Ratings

| Cities with Most DUIs Rank | #147 |

| Cities with Most Moving Violations Rank | #160 |

| Most Popular Car in state | Honda Civic |

| Cities with Most Speeding Tickets Rank | #150 |

| Cities with Most Suspended Licenses Rank | #62 |

Averages

| Los Angeles Average (annual) | California Average | United States Average |

| $2650 | $1867 | $1566 |

Group by Genders

| Marital Status/Gender | Average Annual Rate |

| Female | $2653 |

| Male | $2620 |

| Single | $2510 |

| Married | $2519 |

| Divorced | $2653 |

| Widowed | $2587 |

Violations

| Violation/Incident | Average Yearly Rate |

| DWI/DUI | $6977 |

| Reckless Driving | $7151 |

| $1003 | $2635 |

| $2024 | $4745 |

| Speeding Ticket (16-20 mph over speed limit) | $3734 |

Los Angeles Info

| Major Highways | Pacific Coast Highway,Topanga Canyon Boulevard,Santa Monica Boulevard |

| Public Transit | Metro Bus,Metro Rail,Metro Transitway |

| Toll Roads | I-10 Metro Express Lane,I-110 Metro Express Lane, |

Los Angeles Zipcodes

- 90001

- 90002

- 90003

- 90004

- 90005

- 90006

- 90007

- 90008

- 90009

- 90010

- 90011

- 90012

- 90013

- 90014

- 90015

- 90016

- 90017

- 90018

- 90019

- 90020

- 90021

- 90022

- 90023

- 90024

- 90025

- 90026

- 90027

- 90028

- 90029

- 90030

- 90031

- 90032

- 90033

- 90034

- 90035

- 90036

- 90037

- 90038

- 90039

- 90040

- 90041

- 90042

- 90043

- 90044

- 90045

- 90046

- 90047

- 90048

- 90049

- 90050

- 90051

- 90052

- 90053

- 90054

- 90055

- 90056

- 90057

- 90058

- 90059

- 90060

- 90061

- 90062

- 90063

- 90064

- 90065

- 90066

- 90067

- 90068

- 90070

- 90071

- 90072

- 90073

- 90074

- 90075

- 90076

- 90077

- 90078

- 90079

- 90080

- 90081

- 90082

- 90083

- 90084

- 90086

- 90087

- 90088

- 90089

- 90091

- 90093

- 90095

- 90096

- 90099

- 90101

- 90102

- 90103

- 90189

Other cities of same state

- Victorville Car Insurance

- Laguna Niguel Car Insurance

- Costa Mesa Car Insurance

- Hacienda Heights Car Insurance

Other cities from different states

Potential Rate Discounts

If you qualify for discounts, you may save the amounts shown below.

| Discount | Savings |

|---|---|

| Multi-policy | $64 |

| Multi-vehicle | $61 |

| Homeowner | $17 |

| 5-yr Accident Free | $81 |

| 5-yr Claim Free | $86 |

| Paid in Full/EFT | $47 |

| Advance Quote | $66 |

| Online Quote | $94 |

Compare Rates and Save

Find companies with the cheapest rates in your area

Discounts are estimated and may not be available from every company or in every state.