Ogden Car Insurance - Utah

Enter your zip code below to view companies that have cheap auto insurance rates.

Having car insurance is a definite must if you're a ride owner in Ogden. It may work to your utmost advantage particularly if you get involved with a car disaster in which you are the person who's liable. Having auto insurance is also beneficial if it's another individual who's at fault, and he or she does not have car insurance.

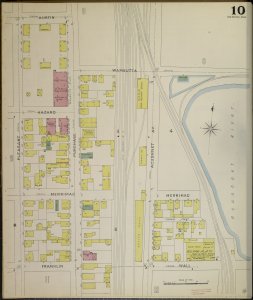

There are numerous reasons why being a resident and a driver in Ogden calls for having auto insurance. Among the main ones is the fact that it's a populous city in Utah. To give you an idea, for a particular square kilometer, you will find 1233 locals. According to the newest census, the city has 87,031 dwellers.

Here's a breakdown of the residents based on race or ethnicity:

- White (84.8percent)

- Afro-American (1.6percent)

- Asian (1.2percent)

- Native Americans and Alaskans (1.1%)

- Bi- or Multi-racial (3.9%)

- Others (7.1percent)

The population is composed of 51.6% males and [females]% ladies. The percentage of married spouses is 44.8%, and the median age is 31 years old.

Since Ogden is populous, the risk of becoming involved in an auto crash is increased. The logic is easy: the greater people there are, the more rides are possessed; and the greater vehicles that you share the street with, the more the accident risk. It's because of this it's important for any vehicle owner in the city to have automobile insurance.

Regrettably, some persons refuse to purchase automobile insurance. Among the reasons forsuch is that they think that the monthly or annual premiums can render a ugly dent in the budget. However, the fact is that it's not having any automobile insurance that can cause a local resident with a vehicle to wind up broke.

If you do not have automobile insurance then, your wallet is in danger. This is especially true if you become involved in a car disaster where you are the one who's at fault. Not having car insurance means you will need to pay for the cost of getting another party's ride repaired or replaced.

The fiscal burden does not start and end there. If the vehicle your own ride collided with has multiple passengers, you will have to look after each one's medical requirements and a lot more.

In the Ogden, 3.43 is the mean family size. What if the vehicle you crashed into is a family auto and all of the family members were inside? If this is true, just imagine how much moolah it would cost to give each one medical care. Regrettably it's not merely the hospitalization that you will have to shoulder. If some or all of them have jobs and the injuries brought about by the crash can stop them from going to work, then you'll also have to cover all the losses!

You don't like that to happen in a city where the median household income amounts to $43361 and about 12.3% have six-figure salaries!

In a car disaster, it's not only automobiles that may get damaged but possessions, also. This means you will also have to pay the repair or replacement of a part of the house that your ride crashed into. It's not going to be cheap knowing that the mean value of owned properties in the area is equivalent to $140282, states a 2017 study.

Even rented homes aren't cheap: based on the same 2017 survey, the median quantity of rent that local families in Ogden shell out totals $924.

Being a careful driver is not an excuse for you to skip buying automobile insurance. Even if your risk of colliding with another car is extremely low since you drive your ride excellently, there's still a big chance that a reckless driver will wreck her or his automobile in your vehicle. There's no need to panic about the consequent expenses if the party who is at fault has auto insurance. But what if he or she does not posses one? And what if he or she is not making fantastic money?

There is a chance that the party who is at fault doesn't have work. A 2017 survey states that around 6.4% of individuals living in Ogden are jobless. On the flip side, the same study claims that 64.5% of the city's inhabitants are working. By the way, around 19.8% of the natives have college diplomas.

As you can see, it can be quite helpful for you to have auto insurance. Refrain from thinking that it's costlier than simply taking good care of automobile accident-related costs with your own money. There are various approaches to maintain your monthly or annual premiums low, thus letting you to get protection without going broke.

Car insurance companies won't be afraid to lower your monthly or annual rate if they realize that you're a cautious person. 1 way to demonstrate that you are doing your best to fend off injuries is by simply installing your car with various protective capabilities. A common example is getting side airbags. You might also equip your car or truck with GPS that will inform the auto insurance carrier of this -111.9677 (longitude) and 41.2280 (latitude), as proof that you are not leaving your ride anywhere.

Being a vehicle owner in Ogden, there are many reasons to get your hands on automobile insurance. To get the safety and peace of mind that you enjoy, search for one today during America/Denver business hours!

Ogden Cheapest Companies

| Cheapest Companies | Quotes |

|---|---|

Allstate | $83/mo |

State Farm | $135/mo |

The General | $151/mo |

American Family | $170/mo |

Around Cities

Utah Cities | |

|---|---|

| Salt Lake City | $133/mo |

| Provo | $121/mo |

| West Jordan | $126/mo |

| Orem | $131/mo |

| Ogden | $135/mo |

| Utah | $129/mo |

Ogden Best Companies

| Best Companies | Score ? | Quotes ? |

|---|---|---|

Clearcover | 97 | $100/mo |

American Family | 89 | $169/mo |

Nationwide | 89 | $175/mo |

Safeco | 86 | $188/mo |

Liberty Mutual | 82 | $193/mo |

Ogden Drivers by Age

| Driver Age | Avg. Monthly Cost |

|---|---|

| teens | $300 |

| 20s | $202 |

| 30s | $154 |

| 40s | $165 |

| 50s | $136 |

| 60s | $116 |

| 70s | $144 |

| 80s | $196 |

Driving History

| Driving History | Avg. Monthly Cost |

|---|---|

| No Violation | $153 |

| Speeding Ticket | $188 |

| At-Fault Accident | $210 |

| Failure to Stop for Red Light / Stop Sign | $221 |

Ogden Scores

| Credit Tie | Avg. Monthly Cost |

|---|---|

| Excellent | $170 |

| Good | $148 |

| Average | $181 |

| Poor | $166 |

Ogden Ratings

| Cities with Most DUIs Rank | #4 |

| Cities with Most Moving Violations Rank | #12 |

| Most Popular Car in state | Honda Accord |

| Cities with Most Speeding Tickets Rank | #19 |

| Cities with Most Suspended Licenses Rank | #7 |

Ogden Zipcodes

- 84201

- 84244

- 84401

- 84402

- 84403

- 84404

- 84405

- 84407

- 84408

- 84409

- 84412

- 84414

- 84415

Other cities of same state

Other cities from different states

Potential Rate Discounts

If you qualify for discounts, you may save the amounts shown below.

| Discount | Savings |

|---|---|

| Multi-policy | $64 |

| Multi-vehicle | $61 |

| Homeowner | $17 |

| 5-yr Accident Free | $81 |

| 5-yr Claim Free | $86 |

| Paid in Full/EFT | $47 |

| Advance Quote | $66 |

| Online Quote | $94 |

Compare Rates and Save

Find companies with the cheapest rates in your area

Discounts are estimated and may not be available from every company or in every state.